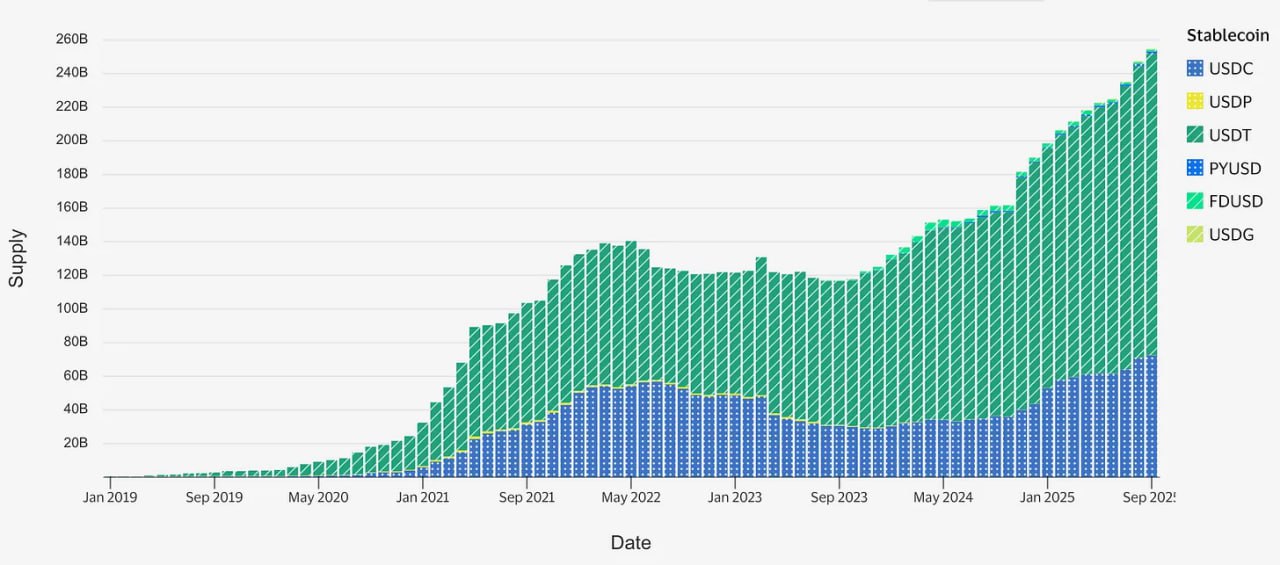

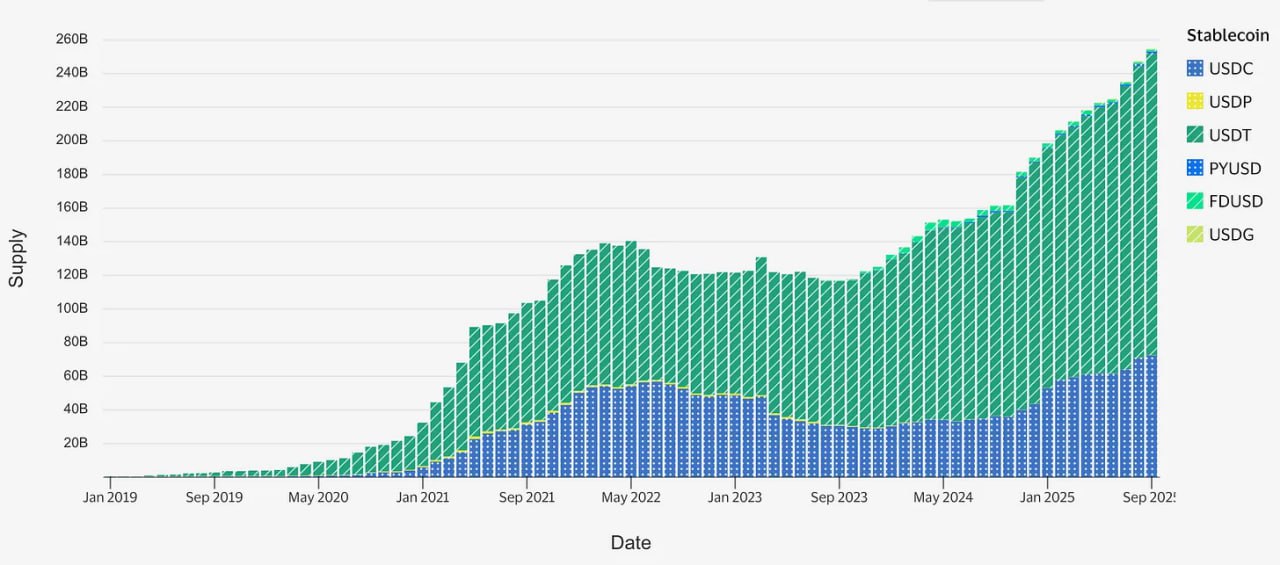

The 2025 TradFi blockchain playbook: Blockchains have moved from POC to production for money movement, collateral, and fund distribution. Regulatory clarity in the U.S., EU, and Hong Kong lowers policy risk, while rising stablecoin volumes and tokenized fund AUM show real demand. The near-term winners will be banks and asset managers that pair public-chain reach with permissioned controls, measurable KPIs, and disciplined custody.

insights4vc.substack •