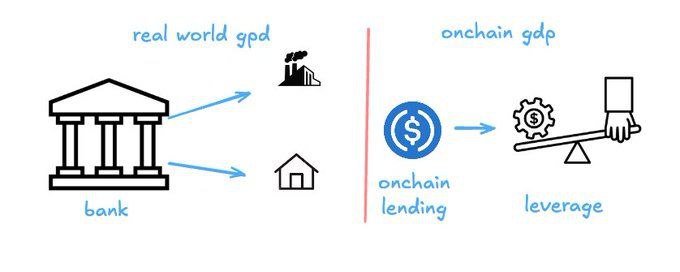

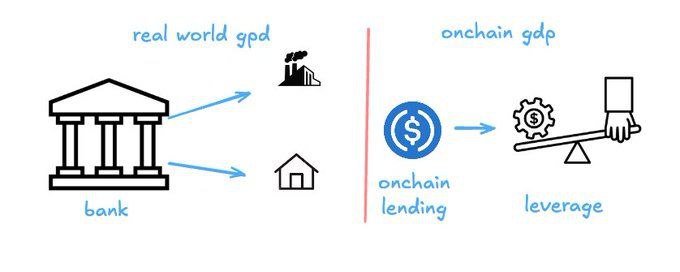

Banks earn far higher margins than DeFi lenders like Aave because crypto lending is dominated by leverage and yield loops, not real-economy credit. As onchain lending expands into RWAs and structured credit, margins could rise beyond crypto cycles.

𝕏/@SilvioBusonero •