Posted byJLJohn

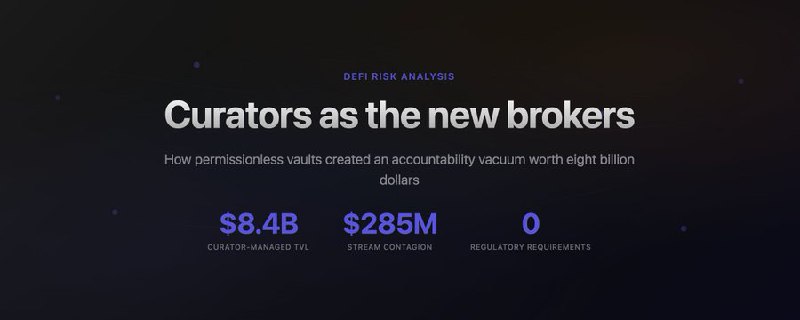

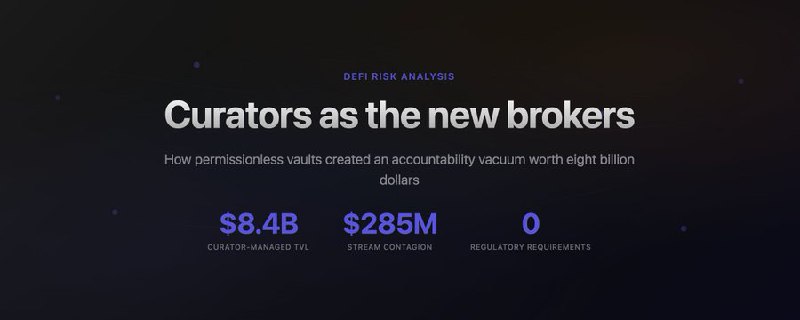

A new class of unregulated DeFi intermediaries risk curators and vault managers now oversees billions in user deposits, sets risk parameters, chooses collateral, and takes 5–15% in fees despite operating without licenses, oversight, disclosures, or even verified identities.

𝕏/@yq_acc •

View article